Local Look Western Washington Housing Update 7/7/25

After a quieter May, home buyers across Western Washington returned in June, nudging sales and prices slightly higher. The good news for buyers? Inventory is also growing, which could mean more negotiating power this summer.

Hi. I’m Jeff Tucker, principal economist at Windermere Real Estate, and this is a Local Look at the June 2025 data from the Northwest MLS.

Here are the four key metrics I watch to track supply and demand in the market: closed and pending sales, which tell us a lot about demand; and listings – new and active – which tell us a lot about supply.

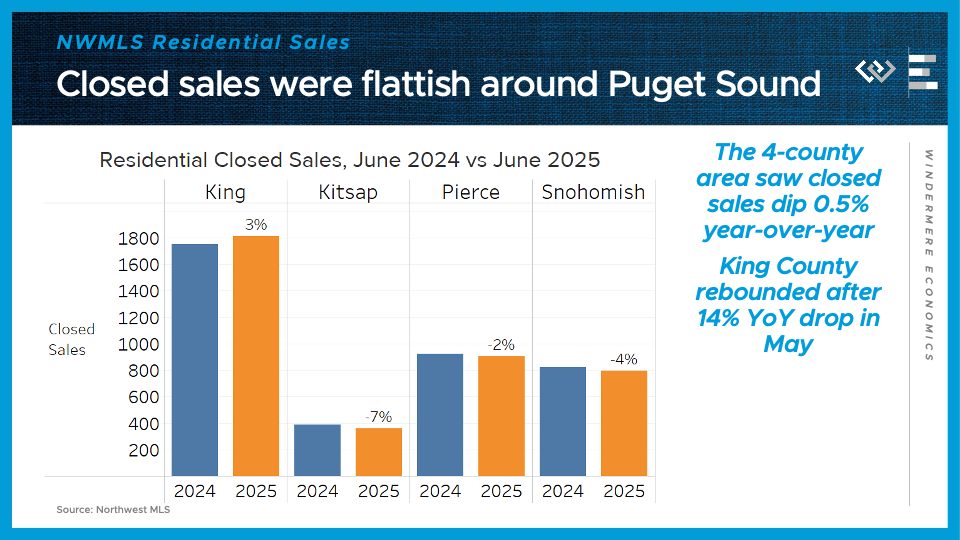

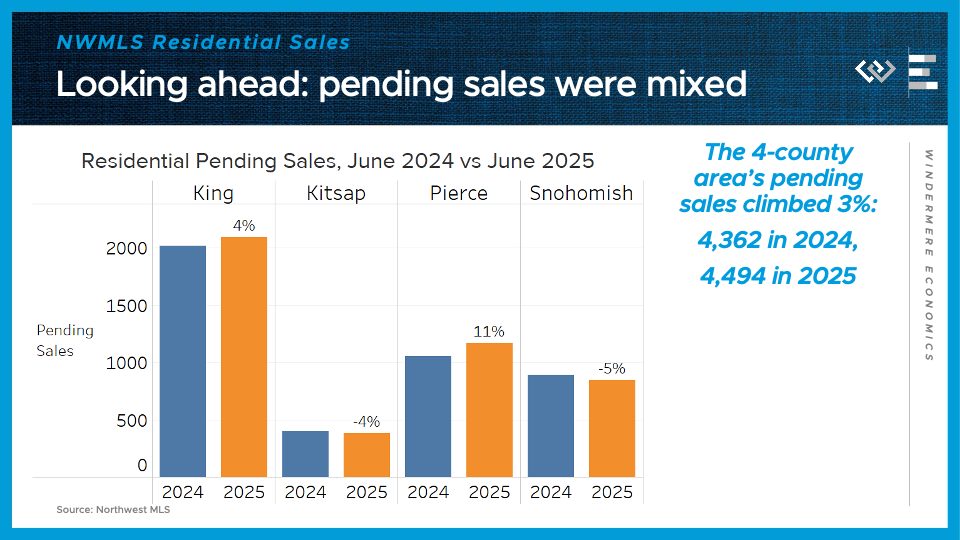

Last month I highlighted the year-over-year decline in closed sales in May, as fallout from the stock market dip and economic turmoil in April; now I’m happy to share that like the stock market, the housing market has rebounded after that speed bump in May. Closed residential sales across the Northwest MLS in June were almost exactly the same as their year-ago level. Pending sales of single-family homes climbed 3% year-over-year.

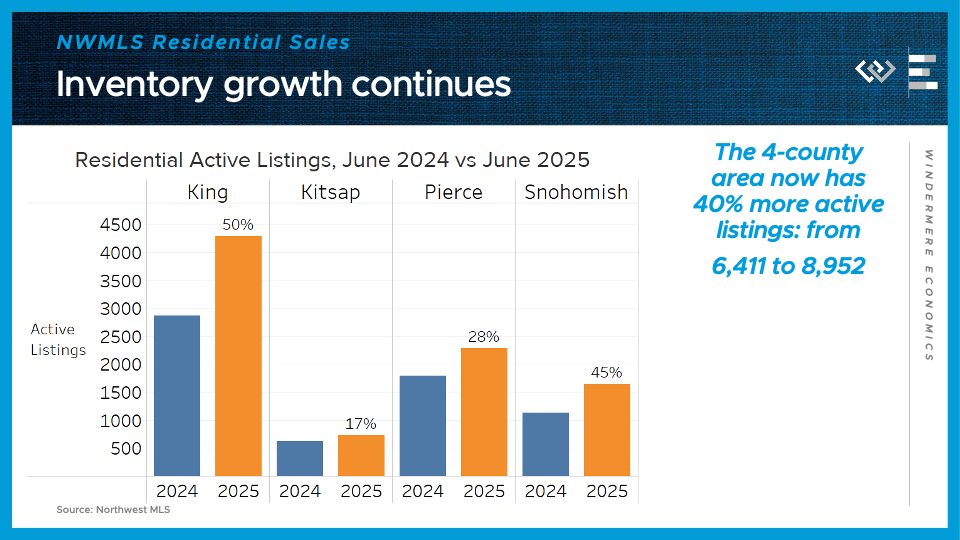

On the supply side, about 12% more new listings hit the market this June, and the tally of active listings ended the month 37% higher than June 2024’s inventory. That’s a lot more inventory, but the pace of year-over-year growth is slightly slower than the 39% we saw last month.

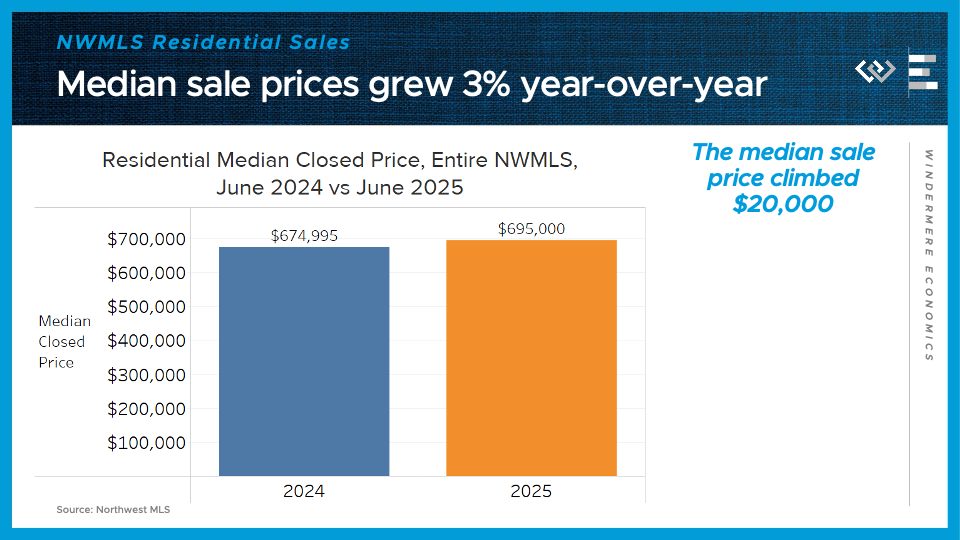

Finally: the median price for closed single-family home sales actually climbed 3% from last year, to $695,000. That reverses the 1% decline in May, and actually sets a new high-water mark for the year, above the $680,000 price level in April.

So putting it all together, buyers around Washington came back to the table in June after stepping away in May, and they helped drive more sales and higher prices. Looking ahead, the high level of inventory we’ve got on the market at the midpoint of the year suggests that buyers will get more negotiating power later this summer.

Now I’ll dig into details for the four counties encompassing the greater Seattle area.

Residential closed sales dipped by just half of one percent year over year here in the 4-county region, thanks to a 3% gain in King County mostly offsetting some small declines in the other counties. That gain for King County was especially notable after it posted a whopping 14% year-over-year decline in May, suggesting that some buyers got back into the market after pressing “pause” earlier this spring.

Similarly, King County saw the biggest gain in median sale price, climbing 7% from a year ago and now back over a million dollars. Kitsap and Pierce saw prices climb 4% and 5%, while prices dipped 2% in Snohomish County.

Looking ahead, pending sales returned to modest year-over-year increases, totaling 3% across the region, led by 11% more in Pierce and 4% more in King County, offset somewhat by declines of 4% in Kitsap and 5% in Snohomish County.

On the supply side, the 4-county greater Seattle area had almost 9,000 active listings at the end of June, or 40% more than the same time last year. Still, if that sounds dramatic, it’s a small percentage gain than the 45% year-on-year growth in May, suggesting that the inventory buildup is decelerating.

All in all, this report confirmed that greater-Seattle-region buyers came back to the table in June – not in huge numbers, but more like a return to the new normal of sales activity, after many buyers had pressed “pause” in April. Now, the usual seasonal cooldown in demand is likely to begin, just as summer heats up. That will help swing the pendulum in favor of the buyers who keep house-hunting into the second half of the year, and I expect that higher inventory will also start to put some competitive pressure on sellers who haven’t yet gotten an offer.

Read More